Options for overgrown (calendar spread "l). Calendar spread and its features Tricks of calendar spreads on options

Calendar call spread

Call calendar spread refers to one of the types of calendar spreads. The other two types are the Calendar Put Spread and the Proportional Calendar Spread. At its core, the Calendar Call Spread is a neutral/bullish strategy. And in some ways, this strategy resembles a selling strategy, but is more profitable if the price of the underlying asset remains the same or slightly increases. We can say that the Calendar Call Spread is a modified strategy of covered Call option selling. The modification consists in the fact that instead of the underlying asset, an option with a very long expiration date - LEAP is used here. Therefore, this strategy requires less cost to create it. And the meaning of this strategy remains the same as that of a covered sale - obtaining the time value of the sold options. Since the time decay of short-term options is faster than long-term ones.

Since the Call Calendar Spread contains long term options bought that are more expensive than near term sold options, there is a cost to creating this spread, i.e. this spread is a debit spread.

There are two ways to build a calendar call spread. First, you buy and write options with different expiration dates and different strikes. In this case, you will get the Diagonal Spread. Another way is to buy and sell options with different expiration dates, but with the same strikes. Then you will get the Horizontal Spread. Both spreads will be discussed in more detail below. Since both spreads are calendar call spreads, in order to distinguish between them, I will use the mentioned names: Diagonal Spread and Horizontal Spread.

When can this strategy be used?

The use of this strategy may be appropriate when the price of the underlying asset is expected to remain unchanged or slightly increase.

How exactly to build this strategy?

Diagonal spread

To build this strategy, you must buy a Call option in money(ITM) with a long expiration date and immediately sell the option on money(ATM) or out of money(OTM) with the nearest due date.

For example:

BUY +10 QQQQ 100 (Quarterlys) JUN5 10 35 CALL @8.15 LMT

Why did we buy the option in money(ITM), not on money(ATM) or out of money(OTM)? The point is that the purchased option in money has a larger delta than the delta of the sold near-term option. Thus, this guarantees us that in the event of an increase in the price of the underlying asset, our purchased option will add in value faster than the sold one.

Horizontal spread

To implement this strategy, you must buy a Call option on money(ATM) with a long expiration date and sell a Call option on money(ATM) with the nearest due date.

For example:

BUY +10 QQQQ 100 (Quarterlys) JUN5 10 42 CALL @3.56 LMT

In this case, creating a calendar spread will cost less than building a diagonal spread. Therefore, with the same costs for this or that strategy, this strategy will have the best return in percentage on invested funds.

The disadvantage of the Horizontal Spread strategy is that if the price of the underlying asset moves well up, you can incur losses, unlike using the Diagonal Spread. This is due to the fact that the short-term written option on money has a larger delta than the purchased option on money with a long deadline. And if so, then you will lose more on a short option than earn on a long one. Therefore, the Horizontal spread strategy must be used with full confidence that the price of the underlying asset will fluctuate at a certain level.

Potential Profit of Calendar Call Spread

Diagonal spread

In the event that at the time of expiration the price of the underlying asset is at or slightly below the strike level of the sold option, then the short option will expire worthless. Thus, you will keep the entire profit from the sale for yourself. If by the expiration time of the short option the price of the underlying asset is higher than the strike of the near-term option and continues to rise, then you will also make a profit. Since the purchased option will add in value faster than the sold one, due to the larger delta. You can get the maximum profit if the price of the underlying asset at the time of expiration of the short option is exactly equal to the strike of the sold option.

Horizontal spread

The horizontal call spread will make a profit if the price of the underlying asset at the time of expiration of the sold option is at or slightly above the strike level of the short option. The difference between the Horizontal spread and the Diagonal spread is that if the price of the underlying asset rises higher, the latter will remain profitable. (Remember the delta). While the Horizontal spread can bring a loss in case of a significant increase in the price of the underlying asset.

The horizontal spread will bring the maximum profit if the price of the underlying asset is exactly equal to the strike of the short option at the time of its expiration.

The maximum losses for both spreads are limited and equal to the cost of creating the spread.

The calendar spread (CS) is a new service on the Derivatives Market of the Moscow Exchange, which allows you to simultaneously make opposite transactions (sell and buy) with two futures of different settlement dates for one underlying asset.

The first leg of the QC is a futures with a near expiration date, the second leg is a futures with a far expiration date. At the first stage of the implementation of the COP, the long-term deadline will be the deadline following the short one (for example, June-September). The spread will include futures on the RTS Index and futures on the USD/RUB rate. In the future, it is planned to expand the range of KS.

KS designation:

| Long Spread Code | Spread short code | First leg | Second leg |

|---|---|---|---|

| RTS-6.13-9.13 | RIM3RIU3 | RTS-6.13 (RIM3) | RTS-9.13 (RIU3) |

| Si-6.13-9.13 | SiM3SiU3 | Si-6.13 (SiM3) | Si-9.13 (SiU3) |

| GOLD-6.13-9.13 | GDM3GDU3 | GOLD-6.13 (GDM3) | GOLD-9.13 (GDU3) |

Spread trading:

- The trader submits a new type of order - the "Calendar Spread" order.

- Supported order categories: limit, market, fill or kill.

- The order enters the glass of spreads. The Depth of Spread is not connected to the Depth of Futures (legs) that make up the spread.

- The order will be executed when the order price for the purchase of the CS in the glass of spreads coincides with the price of the order for the sale of the KS.

- It is possible to submit targeted applications to the CC.

- As the price in the order, the value of the spread (the difference between the prices of the far and near futures) is indicated, which can be positive, negative or zero.

- The spread price step is equal to the price step of the futures included in the spread.

- The trading time coincides with the trading time of the futures included in the spread.

- The last day of CS trading coincides with the last day of trading near futures.

Warranty:

To calculate margin, an order on calendar spreads should be considered as two fictitious orders on instruments included in the spread.

When matching an order into a deal, GO is reserved in the same amount as when matching 2 atomic orders into deals for instruments included in the spread.

Result of spread trading:

An example of using a spread (rolling a position):

Investor A is long 4 contracts of RIM3. In order to roll over his position from RIM3 to RIU3, Investor A must buy 4 calendar spreads of RIM3RIU3. As a result, he closes 4 positions on RIM3 and opens 4 positions on RIU3.

Exchange fee:

- Calculation of the fee for Calendar Spreads in respect of all futures contracts (except for futures contracts for the OFZ basket) concluded on the basis of unaddressed Orders "Calendar Spread" , is produced by the formula:

Fee CS = T * F * (1-K)

Fee CS - fee for Calendar Spreads in respect of futures contracts concluded on the basis of unaddressed "Calendar Spread" Orders during the Trading Day;

T - the number of futures contracts concluded on the basis of unaddressed "Calendar Spread" Orders during the Trading Day;

F - the amount of the exchange fee payable for the conclusion of futures contracts on the basis of unaddressed "Calendar Spread" Orders during the Trading Day (for registration of unaddressed transactions in accordance with Section 3 of the Tariffs);

K - a discount rate equal to 0.2 (two tenths), which is applied when calculating the fee for Calendar Spreads in case of conclusion of futures contracts on the basis of unaddressed "Calendar Spread" Orders and is valid during the marketing period. The marketing period is:

- 18 (eighteen) months from the first Trading Day, starting from which it is possible to conclude futures contracts for a basket of federal loan bonds on the basis of unaddressed "Calendar Spread" Orders;

- 6 (six) months from the first Trading Day, starting from which it is possible to conclude futures contracts for other underlying assets on the basis of unaddressed "Calendar Spread" Orders.

After the expiration of the marketing period established for the conclusion of futures contracts specified in clause 5.3. Tariffs, the discount rate (K) is not applied (equal to zero).

- Calculation of the fee for Calendar Spreads in respect of all futures contracts concluded on the basis of targeted Orders "Calendar Spread" during the trading day, is made according to the formula:

Fee CS = T * F

FeeCS - amount of the fee for Calendar Spreads in respect of futures contracts concluded on the basis of targeted "Calendar Spread" Orders during the Trading Day;

T - the number of futures contracts concluded on the basis of targeted Orders "Calendar spread" during the Trading day;

F - the amount of the exchange fee payable for the conclusion of futures contracts on the basis of targeted Orders "Calendar Spread" during the Trading Day (for registration of targeted transactions in accordance with Section 3 of the Tariffs);

Transaction fee:

- Announcing and deleting a QC order is considered as one transaction - that is, a trading participant using a QC makes 2 times fewer transactions compared to a participant trading directly in the futures cups included in the spread.

Reports containing information on calendar spreads

Reports on calendar spreads are provided following the results of the evening clearing session:

- Report on concluded deals on calendar spreads: ;

- Information about all deals calendar spread: ;

- Log of actions for placing, mixing and deleting orders calendar spread: ;

- Information about calendar spread instruments: , which instruments the calendar spread consists of;

- The report contains the id_mult field, a sign of a technical deal that is part of a related deal, this field contains the identification number of the related deal. For ordinary transactions, the sign is not specified. The value matches the id_deal from the report.

- The f07.csv report contains the multileg field, which is the indicator of the calendar spread instrument.

- In fpos_XXYY.csv reports, the position value changes only for atomic instruments. Example: a deal on RTS-12.17-3.18 will change positions on instruments RTS-12.17 and RTS-3.18, position on RTS-12.17-3.18 is not maintained.

(section 2).

Turnover based on calendar spreads for the current trading day

The high volatility seen at market peaks provides the option trader with a huge profit potential if the option strategy is chosen wisely. Many traders who are only familiar with options buying strategies often fail to achieve positive results in a volatile market.

Strategies such as buying calls or puts, bullish or bearish vertical spreads are ineffective in conditions of high expected volatility (Implied Volatility or IV). Even if you open the right positions at the very bottom or peak of the market, most of the profits will be lost due to lower expected volatility.

The use of technical indicators to identify market extremes is also questionable. For example, when using oscillators, markets can be overbought/oversold indefinitely while the market continues to trend.

On the one hand, the presented strategy has a small risk of losses, on the other hand, it has a good profit potential in case of a trend change or its further continuation. However, more importantly, we have the opportunity to profit from lower expected volatility. Thus, by selling volatility or getting into a short position on vega, we get additional profit opportunities.

Vega is one of the Greeks who determines how much the price of an option will change when the expected volatility changes by 1%. For example, if expected volatility falls from extreme levels to normal levels, the trader who bought the option (long the vega position) will lose because the option price declines.

In conditions of high expected volatility, it is preferable to use the strategy of selling options (ie, get into a short position on vega), as lowering the expected volatility will give us a profit. However, a situation of further growth in expected volatility is possible, which can lead to losses. Therefore, we must minimize these risks.

Reverse calendar spread.

One of the best strategies based on the idea of selling high expected volatility is the Reverse Calendar Spread option strategy.

The usual use of the calendar spread strategy is neutral and involves buying 3-month options and simultaneously selling monthly options with the same strike price. This strategy is often used if the market is expected to move in a range. The profit comes from the fact that time decay has a greater effect on options with a closer expiration date.

However, we will use another version of this strategy - we buy monthly options and sell 3-month options. Using this strategy, we have the opportunity to profit in the event of a serious increase or decrease, as well as from a decrease in expected volatility. The risks of the strategy lie in the faster time decay of short-term options. Consider the use of the strategy on the example of derivatives on the RTS index.

So, let's analyze the chart of futures for the RTS index, on October 30, 2007, there is increased volatility and a high probability of a change in trend, IV was about 25%.

We use the reverse calendar spread strategy. To do this, we buy a monthly put on the RTS index with a strike of 230,000 and simultaneously sell a 3-month put on the RTS index with the same strike.

Spread is the difference between buying and selling for the same thing. A future on a ruble costs 81 rubles and at the same time 79 rubles. This is a spread. In general, I will not be stupid, but I will start about options. Our options are quarterly with repayment every month. The specification is described on the exchange. And here there are some inefficiencies that can be exploited. Each option series has its own volatility. Options of different series have their own properties. And these properties correspond to BS. There are tempting ideas to use these properties. I will try to explain this with examples using fingers and pictures.

We will consider a spread in the form of a cat. Bought strandangle distant and sold near. But let's start in order. This strategy is also called the option firebox. We balance between a larger theta of the near strangle and neutralize the vega of the far series. Imagine a domestic situation. You need to cook soup, or smelt TNT from a World War II bomb. For work on the stock exchange, the second is closer in essence. You take a large pot with some water and put it on the fire.

On the fingers, it looks like a raised fist with the index and little fingers sticking out. Horned goat. Just need more fingers. I have four strikes in between. The main property of this pan is that water evaporates from it slowly. Theta at 130 rubles. But the change in volatility has a stronger effect. True, it does not jump very much on long options, but we will keep this in mind.

Now we will put our bomb in our pot, in the form of a sold strandangle. Well, I won’t explain to you that this is a real bomb.

On the fingers it is a goat, only the muzzle down. And now we bring these goats together. It turns out a cat, or a tiger, who is friends with a goat.

Please note that the options are balanced for zero Vega. That is, we must receive Theta without risking that the volatility will change. GO is one position less than just selling a strangle. The delta is flat, the edges are distant, in general a risk-free position. And if you show it to a sapper who smelts TNT from a bomb, he will show you a goat, only with the middle finger. Naturally, the position must be controlled.

What can happen to us? If the market calms down and the neighbors' ox goes down, Vega will begin to boil. You can add near options. If the outrage continues, then you can add a spark. Buy more distant, saucepan, options. Here it is necessary to look at liquidity. It's like cooking over a fire. Do not throw all the firewood at once and do not pour all the water into the pot, but balance.

Then my advice ends. Here I can not explain how a good cook differs from a very good one. I feel the taste, but I don’t understand the chef’s appearance. So is trading. I showed you the pot, I showed you the stredlicks and the strangles, let's cook. And if you have perseverance and obsession, then everything will work out. You'll cook strangles like scrambled eggs for breakfast. And no iron, all natural. I wish you all good luck. There will be questions, write.

PS Special thanks to our Sberbank and personally German Gref for the fact that we have them. Otherwise, I would have to show examples on Goldman and Sachs options.

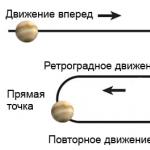

The Calendar Spread is also called the Time Spread because, from a theoretical point of view, it attempts to take the difference (to spread) from the time, and not from the price (although the price is also a factor in the behavior of this Spread). A stock options calendar spread consists of buying an option expiring in a specified future month and selling an option with the same strike price expiring in a later month. For example, if the current month is April, then buying the IBM-July 80 call and selling the 1BM-May 80 call would be the Calendar Spread. As time passes and the May expiration approaches, the temporary decline in the value of securities will begin to put more pressure on the May 80 call (which is short) than it is on the July call (which is long). When this happens, this Spread will make money if the underlying asset is close to the strike price.

Calendar Spreads are sometimes referred to as Horizontal Spreads to reflect the fact that the Spread spans different expiry months, as opposed to Vertical Spreads where the Spread spans different strikes.

A real spread trader (spreader) will close this position at the time of the May expiration or before, because he is interested in the characteristics of the Spread itself - it will expand if the underlying asset remains near the strike price, and narrow if the underlying asset moves too far from the strike price . The profitability of the Calendar Spread at the nearer expiration is shown in Figure 2.15. The Spread has limited profit potential and limited risk, and is limited to the amount originally paid for that Spread (in this it is similar to the Vertical Spreads described earlier).

A more aggressive approach is to continue holding long call options after the short options have expired. However, we do not recommend this approach to the Calendar Spread strategy.

One of the biggest differences between stock (or index) options and futures options is that futures options don't necessarily have expiration months directly related. Therefore, you must be careful when creating Calendar Spreads with futures contracts. For example, you may have options on March and June futures for the Swiss franc. If you buy the June option and sell the March option, you don't necessarily get a Calendar Spread in the same sense as we had in the IBM example. The reason is that the underlying of your two Swiss Franc options are two different futures contracts, the June contract and the March contract, while in the IBM example, IBM stock is the underlying asset for both Calendar Spread options.

The statement that the March Swiss franc futures and the June Swiss franc futures are related to each other is true, but they do not necessarily move.

Figure 2.15 CALENDAR SPREAD

together. In fact, for some futures - especially those whose underlying asset is real commodities - grain or oil - the calendar spread between two futures contracts can fluctuate very much. This fluctuation of the Spread will cause the corresponding options to behave in a way that does not occur in Calendar Spreads for stocks or indices. This fluctuation can even cause the value of the options to invert to the point where the option with the nearer expiration date sells for a higher price than the remote one. The following example may be helpful.

Example. Let's say it's February and you notice that options on the March Swiss franc (5P) are more expensive than options on the June franc. Therefore, you want to create a Calendar Spread. Prices may be as follows:

June-79-call: 2.00

Your first desire is to try to create a Calendar Spread by buying the June 78 call and selling the March 78 call. However, even though the strikes of the call options are the same, the 78.00 March call is one pip out of the money, while the June call is near the money. This increases the debit you have to pay initially for the Spread and effectively makes it a bullish position. A more neutral Calendar Spread would be to use call options. At the initial moment of time, they are “out of the money” at the same distance: buy the June-79 call and sell the March-78 call. Both options are out of the money by one pip.

However, even in this case, the spreader is subject to the vicissitudes of the relative movements of the March and June 5E futures. For example, if interest rates in the United States or Switzerland change, the price differential between the two futures contracts will certainly change as well.

Currency futures have serial options. So there should be SF options expiring in April and May. Moreover, the actual futures contract - the base for these serial options - is the June futures contract. Thus, a real Calendar Spread can be created by buying the June BR call and selling the April or Maft SF call. In this case, the only variable in the Option Spread will be time, since the same contract, the June Swiss Franc futures contract, is the underlying for both options.