The concept of economic (entrepreneurial) activity. The concept of economic law. Organization of economic activity

Section 2. Organization of economic activity

In this section of the textbook, the study of the system of economic relations continues. After considering the subsystem of socio-economic relations, we will now understand the subsystem of organizational and economic relations, without which economic activity cannot exist and develop. This will allow us to find out how production is organized, by whom it is managed and in what organizational, economic and legal forms it achieves its goals.

Topic 4. Enterprises and organizations in the economy

4.1. Economic and legal characteristics of the enterprise

The primary link in the system of social production is the enterprise (firm). Company is an independent economic entity created to produce products, perform work and provide services in order to meet social needs and make a profit.

A manufacturing enterprise is characterized by production, technical, organizational, economic and social unity.

Production and technical unity determined by a complex of means of production with technological unity and interconnection of individual stages production processes as a result of which the raw materials used at the enterprise are converted into finished products. They also allow you to provide services and perform certain work in order to make a profit.

organizational unity is determined by the presence of a single team and a single leadership, which is reflected in the overall and organizational structure of the enterprise.

economic unity is determined by the generality of the economic results of work - the volume of products sold, the level of profitability, the mass of profits, the funds of the enterprise, etc., and, most importantly, making a profit acts as the main goal of the activity.

However, the enterprise, first of all, is not a production, not an economic, but a social unit. An enterprise is a team of people of various qualifications, connected by certain socio-economic relations and interests, and making a profit serves as the basis for meeting the needs (both material and spiritual) of the entire team. Therefore, the most important tasks of the enterprise are: payment of socially just salary, which would ensure the reproduction of the labor force; creation of normal working and leisure conditions, opportunities for professional growth, etc.

An enterprise is not only an economic entity, but also entity . A legal entity is an organization that owns, manages or manages separate property and is liable for its obligations with this property, can acquire and exercise property and personal non-property rights on its own behalf, bear obligations, be a plaintiff and defendant in court. Legal entities must have an independent balance or estimate.

A legal entity is subject to state registration and acts either on the basis of a charter, or a constituent agreement and a charter, or only a constituent agreement.

The charter reflects: organizational and legal forms of the enterprise (firm); Name; mailing address; the subject and purpose of the activity; statutory fund; the procedure for distributing profits; control bodies; list and location of structural units that are part of the company; terms of reorganization and liquidation.

Firm - legally independent business unit. It can be both a large enterprise or organization, and a small company. A modern firm usually includes several enterprises. If the firm consists of one enterprise, both terms coincide. In this case, the enterprise and the firm designate the same object of economic activity. The firm in relation to its constituent production units is a body of entrepreneurial management. Usually, it is the firm, and not the enterprise, that acts as an economic entity in the market, implements a pricing policy, competes, participates in the distribution of profits, sets the pace and determines the direction of scientific and technological progress.

A variety of enterprises operate in the economy. They differ from each other in a number of ways: industry affiliation; sizes; the degree of specialization and the scale of production of the same type of products; methods of organizing production and the degree of its mechanization and automation; organizational and legal forms, etc.

Signs industry affiliation enterprises serve: the nature of the raw materials consumed in the manufacture of products; purpose and nature of the finished product; technical and technological community of production; operating time throughout the year. Thus, enterprises and organizations in our country are distributed in statistics, primarily into three groups of production sectors (parts of the national economy):

mining;

processing;

distributing electricity, gas and water.

The importance of these sectors can be judged by general economic indicators (number of organizations, volume of shipped goods and financial result) - table 8.

Table 8

|

1. Key performance indicators of mining, manufacturing and distribution of electricity, gas and water in 2007 |

|

|

Number of operating organizations: | |

|

extracting minerals | |

|

Manufacturing | |

|

Production and distribution of electricity, gas and water | |

|

The volume of shipped goods of own production, performed works and services on their own, billion rubles: | |

|

Mining | |

|

Manufacturing industries | |

|

Production and distribution of electricity, gas, water | |

|

Balanced financial result (profit minus losses), billion rubles | |

|

2. Agriculture has the following structure (according to 2008 data, as a percentage of the total) |

|

|

Agricultural organizations | |

|

Households of the population | |

|

Peasant (farming) households | |

|

3. In construction in 2008, there were: |

|

|

Construction organizations | |

|

The volume of work performed (in actual prices in 1995, billion rubles) | |

By appointment finished products All enterprises are divided into two large groups: producing means of production and producing consumer goods.

By sign technological community distinguish between enterprises with continuous and discrete production processes, with a predominance of mechanical and chemical production processes.

By working hours during the year Distinguish between year-round and seasonal enterprises.

By sign enterprise size are divided into large (with more than 500 employees), medium (with 101 to 500 employees) and small (up to 100 employees). The main criterion for attributing an enterprise to one of these groups is not only the number of employees, but also the volume of permissible turnover. Money.

By specialization and scale of production enterprises of the same type are divided into specialized, diversified and combined.

It is possible to single out enterprises on other grounds. For example, depending on different types of economic and legal relations and the nature production activities companies differ, for example:

rental which manufactures products, performs work and provides services using property on the basis of a lease agreement (for a certain period);

venture- a small enterprise in science-intensive sectors of the economy, carrying out scientific research, engineering development and the introduction of innovations of a risky nature;

closed(in some countries), which has an agreement that only members of a union or those who wish to join a union will be employed in this enterprise;

open in which both members of the trade union and non-members of the trade union are employed;

collective, which was created either when buying out a state-owned enterprise, or when acquiring the property of an enterprise by a labor collective.

The classification of enterprises is important in the development of standard documentation for homogeneous enterprises, the application of standard design and technological solutions, production structure and other purposes.

In accordance with the forms of ownership, enterprises can be state, municipal, private, and may also be owned by public organizations.

by an enterprise like object of rights recognized Property Complex, which is generally real estate. This complex includes all types of property intended for its activities, including: land plots; building; equipment; inventory; raw materials; products.

In addition, this complex includes claims, debts, as well as designations that individualize the enterprise, its products, works and services (company name, trademarks, service marks), and other exclusive rights.

The enterprise operates in industry, agriculture, construction, transport, communications and informatics, science and scientific services, trade, logistics, culture, education, services and other sectors of the national economy. An enterprise can simultaneously conduct several types of economic activity.

1.1 Main activities of the enterprise

Current (main, operating) activity - the activity of an organization that pursues profit making as the main goal, or does not have profit making as such in accordance with the subject and goals of the activity, i.e., production of industrial, agricultural products, construction work, sale goods, the provision of catering services, the procurement of agricultural products, the leasing of property, etc.

Inflows from current activities:

receipt of proceeds from the sale of products (works, services);

Receipts from the resale of goods received by barter;

Receipts from the repayment of receivables;

advances received from buyers and customers.

Outflows from current activities:

payment for purchased goods, works, services;

Issuance of advances for the purchase of goods, works, services;

payment of accounts payable for goods, works, services;

· salary;

payment of dividends, interest;

· payment according to calculations on taxes and fees.

Investment activity - the activity of an organization related to the acquisition of land plots, buildings, other real estate, equipment, intangible assets and other non-current assets, as well as their sale; with the implementation of own construction, expenses for research, development and technological development; with financial investments.

Inflows from investment activities:

receipt of proceeds from the sale of non-current assets;

Receipt of sales proceeds valuable papers and other financial investments;

income from the repayment of loans granted to other organizations;

receiving dividends and interest.

Outflows from investment activities:

payment for acquired non-current assets;

payment of acquired financial investments;

· issuance of advances for the acquisition of non-current assets and financial investments;

granting loans to other organizations;

· Contributions to authorized (share) capitals of other organizations.

Financial activities - the activities of the organization, as a result of which the value and composition of the organization's own capital, borrowed funds change.

Cash inflows from financing activities:

Receipt from the issue of equity securities;

income from loans and credits provided by other organizations.

Outflows from financial activities:

repayment of loans and credits;

Repayment of financial lease obligations.

1.2 The essence and objectives of operating activities

Enterprises operate in the market in a highly competitive environment. Those who lose in this struggle become bankrupt. In order not to go bankrupt, business entities must constantly monitor changes in the market environment, develop methods to counteract negative aspects in order to maintain their competitiveness.

In the process of managing the profit of the enterprise, the main role is given to the formation of profit from operating activities. Operational activity is the main activity of the enterprise, for the purpose of which it was created.

The nature of the operating activity of the enterprise is determined primarily by the specifics of the sector of the economy to which it belongs. The basis of the operating activities of most enterprises is production, commercial or trading activities, which are complemented by their investment and financial activities. At the same time, investment activity is the main one for investment companies, investment funds and other investment institutions, and financial activity is the main one for banks and other financial institutions. But the nature of the activities of such financial and investment institutions, due to its specificity, requires special consideration.

The current activity of the enterprise is aimed primarily at extracting profit from the assets at its disposal. When analyzing this process, the following quantities are usually taken into account:

added value. This indicator is calculated by subtracting from the company's revenue for the reporting period the cost of consumed material assets and services of third parties. For further use of this indicator, it is necessary to deduct value added tax from it;

· Gross result of exploitation of investments (BREI). It is calculated by subtracting from the value added the cost of wages and all taxes and mandatory contributions, except for income tax. BREI represents earnings before income tax, interest on borrowings and depreciation. BREI shows whether the enterprise has enough funds to cover these costs;

Earnings before income tax and interest, EBIT (Earnings before Interest and Taxes). Calculated by subtracting depreciation charges from BREI;

· economic profitability, or income generation ratio (ERR), already mentioned earlier in the section on analysis using financial ratios. Calculated as EBIT divided by the total assets of the enterprise;

commercial margin. It is calculated by dividing EBIT by revenue for the reporting period and shows how much profit before taxes and interest each ruble of the company's turnover gives. In financial analysis, this ratio is considered as one of the factors affecting economic profitability (ER). Indeed, BEP can be thought of as the product of commercial margin times asset turnover.

Achieving a high rate of economic profitability is always associated with the management of its two components: commercial margin and asset turnover. As a rule, an increase in asset turnover is associated with a decrease in commercial margin and vice versa.

Both the commercial margin and asset turnover directly depend on the company's revenue, cost structure, pricing policy and the overall strategy of the company. The simplest analysis shows that the higher the price of products, the higher the commercial margin, but this usually reduces the turnover of assets, which greatly restrains the increase in economic profitability.

Economic profitability is a very useful indicator of the company's performance, but for owners, often more important than such an indicator as return on equity (ROE). To maximize it, it is necessary to choose the optimal capital structure of the company (the ratio of borrowed and own funds). In this case, the analysis of financial risk is carried out by calculating the effect of financial leverage.

The amount of cash flows generated from operating activities is a key indicator of the extent to which a company's operations generate sufficient cash flows to repay loans, maintain operating capacity, pay dividends, and make new investments without recourse to external sources of funding. Information about the specific components of initial operating cash flows, combined with other information, is very useful in predicting future operating cash flows.

Cash flows from operating activities primarily arise from the principal, income-generating activities of the company. As such, they generally result from transactions and other events that are part of the determination of net profit or loss. Examples of operating cash flows are:

cash receipts from the sale of goods and the provision of services;

cash receipts from rent, fees, commissions and other income;

cash payments to suppliers for goods and services;

cash payments to employees and on their behalf;

cash receipts and payments of the insurance company as insurance premiums and claims, annual premiums and other insurance benefits;

cash payments or income tax refunds, unless they can be linked to financial or investment activities;

cash receipts and payments under contracts concluded for commercial or trading purposes. Some transactions, such as the sale of a piece of equipment, may give rise to a gain or loss that is included in the determination of net profit or loss. However, the cash flows associated with such transactions are cash flows from investing activities.

A company may hold securities and loans for commercial or trading purposes, in which case they may be treated as stock purchased specifically for resale. Therefore, cash flows arising from the purchase or sale of commercial or trading securities are classified as operating activities. Similarly, cash advances and loans provided by financial companies are usually classified as operating activities because they are part of the financial company's core income-generating activities.

One of the tools for market research and maintaining competitiveness is the analysis of the financial and economic activities of the enterprise, including the analysis of its financial condition. The order and tools of analysis, which is carried out in order to make financial decisions, is determined by the very logic of the functioning of the financial mechanism of the enterprise.

One of the simplest but most effective types financial analysis, is an operational analysis, called CVP (cost-volum-profit, costs - volume - profit).

The purpose of the analysis of operating activities is to track the dependence of the financial results of the business on costs and sales volumes.

The main task of CVP analysis is to get answers to important questions that entrepreneurs have at all stages of money circulation, for example:

How much capital does a business need to have?

How to mobilize these funds?

To what extent can financial risk be reduced using the effect of financial leverage?

Which is cheaper: buying or renting real estate?

To what extent can you increase strength operating lever, maneuvering variable and fixed costs, thereby changing the level of entrepreneurial risk associated with the activities of the enterprise?

Is it worth it to sell products at prices below cost?

Should we produce more of this or that product?

How will a change in sales volume affect profits?

Cost allocation and gross margin

CVP - analysis serves to find the optimal, most beneficial costs for the enterprise. It requires the allocation of costs to variable and fixed, direct and indirect, relevant and irrelevant.

Variable costs generally change in direct proportion to the volume of production. These can be the costs of raw materials and materials for the main production, the wages of the main production workers, the cost of selling products, etc. It is beneficial for the enterprise to have less variable costs per unit of output, because in this way it secures itself, respectively, more profit. With a change in the volume of production, total variable costs decrease (increase), at the same time, they remain unchanged per unit of output.

Fixed costs must be considered in the short term, the so-called relevant range. In this case, they generally do not change. Fixed costs include rent, depreciation, salaries of managers, etc. Changes in the volume of production have no effect on the size of these costs. However, in terms of a unit of output, these costs change inversely.

Direct costs are the costs of an enterprise that are directly related to the production process or the sale of goods (services). These costs can be easily attributed to a specific type of product. For example, raw materials, materials, wages of key workers, depreciation of specific machines, and others.

Indirect costs are not directly related to the production process and cannot be easily attributed to a specific product. Such costs include the salaries of managers, sales agents, heat, electricity for auxiliary production.

Relevant costs are costs that depend on management decisions.

Irrelevant costs do not depend on management decisions. For example, the manager of an enterprise has a choice: to produce the necessary part for the mechanism or to buy it. The fixed cost of producing the part is $35, and you can buy it for $45. So, in this case, the supplier price is the relevant cost, and the fixed cost of production is the irrelevant cost.

The problem associated with the analysis of fixed costs in production is that it is necessary to distribute their total value over the entire product range. There are several ways to distribute this. For example, the sum of fixed costs relative to the time fund gives the cost rate for 1 hour. If the production of goods takes 1/2 hour, and the rate is 6 c.u. per hour, then the value of fixed costs for the production of this product is 3 c.u.

Mixed costs include elements of fixed and variable costs. For example, the cost of paying for electricity, which is used both for technological purposes and for lighting premises. In the analysis, it is necessary to separate mixed costs into fixed and variable.

The sums of fixed and variable costs represent the total costs for the entire volume of production.

Ideal conditions for business - a combination of low fixed costs with high gross margins. Operational analysis allows you to establish the most beneficial combination of variable and fixed costs, prices and sales volume.

The asset management process aimed at increasing profits is characterized in financial management as leverage. This is such a process, even an insignificant change in which leads to significant changes in performance indicators.

There are three types of leverage, which are determined by recomposing and disaggregating income statement items.

Production (operating) leverage is a potential opportunity to influence gross profit by changing the cost structure and output volume. The effect of operating leverage (leverage) is manifested in the fact that any change in revenue from the sale of products always generates a significant change in profit. This effect is due to varying degrees of influence of the dynamics of fixed and variable costs on the formation of financial results when the volume of production changes. The higher the level of fixed costs, the greater the power of operating leverage. The strength of the influence of the operating lever informs about the level of entrepreneurial risk.

Financial leverage is a tool that affects the profit of an enterprise by changing the structure and volume of long-term liabilities. The effect of financial leverage is that an enterprise using borrowed funds changes the net profitability of its own funds and its dividend opportunities. The level of financial leverage indicates the financial risk associated with the enterprise.

Since interest on a loan is a fixed cost, an increase in the share of borrowed funds in the structure of the financial resources of an enterprise is accompanied by an increase in the strength of the operating leverage and an increase in entrepreneurial risk. The category summarizing the previous two is called production and financial leverage, which is characterized by the relationship of three indicators: revenue, production and financial costs, and net profit.

The risks associated with the enterprise have two main sources:

The very influence of the operating lever, the strength of which depends on the proportion of fixed costs in their total amount and determines the degree of flexibility of the enterprise, generates entrepreneurial risk. This is the risk associated with a specific business in a niche market.

Volatility of the financial conditions of lending, the uncertainty of the owners of shares in the return of investments in the event of the liquidation of an enterprise with a high level of borrowed funds, in fact, the very action of financial leverage generates financial risk.

Operational analysis is often referred to as break-even analysis. Break-even analysis of production is a powerful tool for making managerial decisions. By analyzing break-even production data, the manager can answer questions that arise when changing course of action, namely: what impact on profit will a decrease in the selling price have, how much sales are needed to cover additional fixed costs due to the planned expansion of the enterprise, how many people need to be hired etc. The manager in his work constantly needs to make decisions about the selling price, variables and fixed costs, on the acquisition and use of resources. If he cannot make a reliable forecast of the level of profits and costs, his decisions can only bring harm to the company.

Thus, the purpose of the break-even analysis of activities is to establish what will happen to financial results if a certain level of productivity or production volume changes.

Break-even analysis is based on the relationship between changes in production volume and changes in total profit from sales, costs and net income.

The break-even point is understood as such a point of sales at which costs are equal to the proceeds from the sale of all products, that is, there is neither profit nor loss.

To calculate the break-even point, 3 methods can be used:

Equations

Marginal income;

graphic image.

Despite the difficult economic conditions in which enterprises find themselves today (lack of working capital, tax pressure, uncertainty about the future and other factors), nevertheless, each enterprise must have a strategic financial plan, a budget for a certain period: a month, a quarter, a year or more, for which a budgeting system should be introduced at the enterprise.

Budgeting is the process of planning the future activities of an enterprise and formalizing its results in the form of a system of budgets.

The objectives of budgeting are as follows:

· maintenance of current planning;

Ensuring coordination, cooperation and communication between departments of the enterprise;

to force managers to justify quantitatively their plans;

· substantiation of expenses of the enterprise;

· formation of base for an estimation and control of plans of the enterprise;

Compliance with the requirements of laws and contracts.

The budgeting system at the enterprise is based on the concept of centers and accountability.

Responsibility center is an area of activity within which a manager is personally responsible for the performance indicators that he is obliged to control.

Responsibility accounting - an accounting system that provides control and evaluation of the activities of each responsibility center. The creation and functioning of the accounting system by responsibility centers provides for:

definition of responsibility centers;

· budgeting for each responsibility center;

regular reporting on performance;

· Analysis of the causes of deviations and evaluation of the activities of the center.

In an enterprise, as a rule, there are three types of responsibility centers: a cost center, the head of which is responsible for costs, affects them, but does not affect the income of the unit, the volume of capital investments and is not responsible for them; profit center, the head of which is responsible not only for costs, but also for income, financial results; investment center, the head of which controls costs, revenues, financial results, and investments.

Maintaining budgeting will allow the company to save financial resources, reduce non-production costs, achieve flexibility in managing and controlling product costs.

1.3 Management of the cash flows of the organization in the activities of the organization

The cash flows generated by the current activities of the organization often go into the sphere of investment activities, where they can be used to develop production. However, they can also be directed to the sphere of financial activity for the payment of dividends to shareholders. Current activities are quite often supported by financial and investment activities, which provides an additional inflow of capital and the organization's survival in a crisis situation. In this case, the organization ceases to finance capital investments and suspends the payment of dividends to shareholders.

The cash flow from current activities is characterized by the following features:

current activity is the main component of all economic activity of the organization, therefore, the cash flow generated by it should occupy the largest share in the total cash flow of the organization;

forms and methods of current activities depend on industry characteristics, therefore, in different organizations, cash flow cycles of current activities can vary significantly;

· Operations that determine the current activity are distinguished, as a rule, by regularity, which makes the monetary cycle quite clear;

· Current activity is focused mainly on the commodity market, so its cash flow is related to the state of the commodity market and its individual segments. For example, a shortage of inventories in the market can increase the outflow of money, and overstocking finished products can reduce their influx;

current activities, and hence its cash flow, are inherent in operational risks that can disrupt the cash cycle.

Fixed assets are not included in the cash flow cycle of current activities, since they are part of investing activities, but it is impossible to exclude them from the cash flow cycle. This is explained by the fact that current activities, as a rule, cannot exist without fixed assets, and in addition, part of the costs of investment activities is reimbursed through current activities through depreciation of fixed assets.

Thus, the current and investment activities of the organization are closely related. The cash flow cycle from investing activities is the period of time during which cash invested in non-current assets will return to the organization in the form of accumulated depreciation, interest or proceeds from the sale of these assets.

The cash flow from investing activities is characterized by the following features:

· the investment activity of the organization is subordinate in relation to the current activities, so the inflow and outflow of funds from investment activities should be determined by the pace of development of current activities;

Forms and methods of investment activity are much less dependent on the industry characteristics of the organization than current activities, therefore, in different organizations, the cycles of cash flows of investment activities are usually almost identical;

· the inflow of funds from investment activities in time is usually significantly distant from the outflow, i.e. the cycle is characterized by a long time lag;

investment activity has various forms(acquisition, construction, long-term financial investments, etc.) and different directions of cash flow in certain periods of time (as a rule, outflow, which significantly exceeds inflow, predominates initially, and then vice versa), which makes it difficult to present its cash flow cycle in a sufficiently clear scheme;

· investment activity is associated with both commodity and financial markets, the fluctuations of which often do not coincide and can affect the investment cash flow in different ways. For example, an increase in demand for commodity market may give the organization an additional cash inflow from the sale of fixed assets, but this, as a rule, will lead to a decrease in financial resources in the financial market, which is accompanied by an increase in their value (percentage), which, in turn, can lead to an increase in the organization's cash outflow ;

· the cash flow of investment activities is affected by specific types of risks inherent in investment activities, united by the concept of investment risks, which are more likely to occur than operational ones.

The cash flow cycle of financial activity is the period of time during which money invested in profitable objects will be returned to the organization with interest.

The cash flow from financing activities is characterized by the following features:

financial activity is subordinate in relation to the current and investment activities, therefore, the cash flow of financial activities should not be formed to the detriment of the current and investment activities of the organization;

the volume of cash flow of financial activities should depend on the availability of temporarily free cash, so the cash flow of financial activities may not exist for every organization and not constantly;

financial activity is directly related to the financial market and depends on its state. A developed and stable financial market can stimulate the financial activity of the organization, therefore, provide an increase in the cash flow of this activity, and vice versa;

· financial activities are characterized by specific types of risks, defined as financial risks, which are characterized by a special danger, therefore, they can significantly affect the cash flow.

The cash flows of the organization are closely related to all three types of its activities. Money constantly "flows" from one activity to another. The cash flow of current activities, as a rule, should fuel investment and financing activities. If there is a reverse direction of cash flows, then this indicates an unfavorable financial situation of the organization.

More than 10 thousand years ago, people produced almost nothing, but only scooped everything they needed from the natural environment. Their main activities were gathering, hunting and fishing. As humanity has matured, people's occupations have changed greatly.

What is a modern economy?

Geography of the main types of economic activity

With the advent of new types of economic activity of people, their economy also changed. Agriculture is concerned with growing plants (plant growing) and raising animals (animal husbandry). Therefore, its placement strongly depends both on the characteristics of these living organisms and on natural conditions: relief, climate, soils. Agriculture employs the largest part of the world's working population - almost 50% But the share Agriculture in the total world production - only about 10%.

Industry is divided into mining and manufacturing. The mining industry includes the extraction of various minerals (ores, oil, coal, gas), logging, catching fish and sea animals. It is obvious that its location is due to the location of the extracted natural resources.

Manufacturing enterprises are located according to certain laws, depending on what products and how they produce.

The service sector is a special link in the economy. Its products, unlike those of agriculture and industry, are not things. Services are activities that are important to modern people Keywords: education, health care, trade, transport and communications. The enterprises of this sphere - shops, schools, cafes - are focused on serving people. Therefore, the higher the population density, the more such enterprises.

1. INTRODUCTION……………………………………………………………….

2. MAIN PART……………………………………………………

2.1 THEORETICAL PART………………………………………..

2.1.1 ANALYSIS OF LABOR PRODUCTIVITY FOR

INDUSTRIAL ENTERPRISES…………………… …

2.2 PRACTICAL PART………………………………………...

2.2.1 AGGREGATED BALANCE…………………….………

2.2.2. EVALUATION OF COMPOSITION AND STRUCTURE DYNAMICS

BALANCE ASSETS………………………………………….

2.2.3. EVALUATION OF COMPOSITION AND STRUCTURE DYNAMICS

LIABILITY BALANCE……………………………………………

2.2.4. FINANCIAL SUSTAINABILITY ANALYSIS

ENTERPRISES…………………………………………………

2.2.5. RELATIVE INDICATORS OF FINANCIAL

STABILITY……………………………………………...

2.2.6. LIQUIDITY ANALYSIS AND

SOLVENCY OF THE ENTERPRISE……………….

2.2.7. CASH FLOW ANALYSIS…………….

3. CONCLUSION……………………………………………………………

4. REFERENCES………………………………………………..

5. APPENDICES…………………………………………………………….

1. INTRODUCTION

Transition to market economy requires enterprises to increase production efficiency, competitiveness of products and services based on the introduction of scientific and technological progress, effective forms management and production management, overcoming mismanagement, enhancing entrepreneurship, initiative, etc.

An important role in the implementation of this task is assigned to the analysis financial and economic activities of enterprises. With its help, the ways of development of the enterprise are chosen, plans and management decisions are developed, as well as control over their implementation is carried out, reserves for increasing production efficiency are identified, the performance of the enterprise, its divisions and employees is evaluated.

Analysis of the financial and economic state of the enterprise begins with the study of the balance sheet, its structure, composition and dynamics. For a complete study of the balance sheet, it is necessary to consider the following questions:

Basic concepts of balance;

Meaning and functions of balance

The structure of the balance sheet

First, let's define a balance sheet.

The balance sheet is information about the financial position of an economic unit at a certain point in time, reflecting the value of the property of the enterprise and the cost of funding sources.

In economics, the balance sheet is the main source of information. With it, you can:

Familiarize yourself with the property status of an economic entity;

Determine the solvency of the enterprise: will the organization be able to fulfill its obligations to third parties - shareholders, creditors, buyers, etc.

Determine the final financial result of the enterprise, etc.

The balance sheet is a way of reflecting in monetary terms the state, placement, use of enterprise funds in relation to their sources of financing. In form, the balance sheet consists of two sections of the Asset and Liabilities, the results of which are equal to each other, this equality is the most important sign the correctness of the balance sheet.

The structure of the balance sheet is such that the main parts of the balance sheet and their articles are grouped in a certain way. This is necessary to perform analytical studies and assess the structure of the asset and liability.

When conducting a balance sheet analysis, the following should be considered:

The financial information included in the balance sheet is historical in nature, i.e. shows the position of the enterprise at the time of reporting;

In terms of inflation, there is a biased reflection in the time interval of the results of economic activity;

Financial statements carry information only at the beginning and end of the reporting period, and therefore it is impossible to reliably assess the changes that occur during this period.

Another important aspect of the analysis of the structure of the balance sheet is the definition of the relationship between the asset and the liability of the balance sheet, since in the process of production activity there is a constant transformation of individual elements of the asset and liability balance. Each liability group is functionally linked to the balance sheet asset, for example, loans are intended to replenish working capital. Some of the long-term liabilities finance both current and non-current assets. The same interaction is observed in the case of repayment of external obligations. Current assets must exceed short-term liabilities, that is, part of current assets repays short-term liabilities, the other part repays long-term liabilities, the rest goes to replenish equity.

2. MAIN PART

2.1 THEORETICAL PART

ANALYSIS OF LABOR PRODUCTIVITY AT INDUSTRIAL ENTERPRISES.

To assess the level of labor productivity, a system of generalizing, partial and auxiliary indicators is used.

To general indicators include the average annual, average daily and average hourly output per worker, as well as the average annual output per worker in value terms.

Private indicators - this is the time spent on the production of a unit of a product of a certain type (labor intensity of products) or the output of a product of a certain type in physical terms in one man-day or man-hour.

Auxiliary indicators characterize the time spent on performing a unit of a certain type of work or the amount of work performed per unit of time.

The most general indicator of labor productivity is average annual output per worker. Its value depends not only on the output of workers, but also on the share of the latter in total strength industrial and production personnel, as well as the number of days worked by them and the length of the working day (Fig. 1).

From here average annual output per worker can be represented as a product of the following factors:

GV = UD * D * P * SV. (1)

The calculation of the influence of these factors is carried out by the methods of chain substitution, absolute differences, relative differences or the integral method.

Rice. one . The relationship of factors that determine the average annual output of an employee of an enterprise

Must be analyzed change in average hourly output as one of the main indicators of labor productivity and a factor on which the level of average daily and average annual output of workers depends. The value of this indicator depends

from factors associated with changes in the labor intensity of products and its cost assessment. The first group of factors includes such as the technical level of production, the organization of production, unproductive time spent in connection with marriage and its correction. The second group includes factors associated with a change in the volume of production in terms of value due to a change in the structure of products and the level of cooperative deliveries. To calculate the influence of these factors on the average hourly output, the method of chain substitutions is used. In addition to the planned and actual level of average hourly output, it is necessary to calculate three conditional indicators of its value.

The first conditional indicator of average hourly output should be calculated under conditions comparable to the plan (for productive hours worked, with a planned production structure and with a planned technical level of production). To obtain this indicator, the actual volume of production of marketable products should be adjusted for the amount of its change as a result of structural shifts and cooperative deliveries ∆VPstr, and the amount of time worked - for unproductive time (Tn) and above-planned time savings from the implementation of scientific and technological progress (Tae) which must be predetermined. Calculation algorithm:

SVusl = (VPf±∆VPstr)/(Tf-Tn±Te)

If we compare the result obtained with the planned one, then we will find out how it has changed due to the intensity of labor in connection with the improvement of its organization, since the other conditions are the same:

Second conditional indicator differs from the first one in that, when calculating it, labor costs are not adjusted for Tae

Svusl2=(VPf± ∆VPstr)/(Tf-Tn)

The difference between the obtained and the previous result will show the change in the average hourly output due to extra time savings due to the implementation of scientific and technical progress measures

Third conditional indicator differs from the second one in that the denominator is not adjusted for unproductive time costs:

SVuslZ= (VPf ± А∆VPstr) /Тf

The difference between the third and second conditional indicator reflects the impact of unproductive time expenditure on the level of average hourly output.

If we compare the third conditional indicator with the actual one, we will find out how the average hourly output has changed due to structural changes in production.

An important role in studying the influence of factors on the level of average hourly output is played by the methods of correlation and regression analysis. AT multivariate correlation model of average hourly output the following factors can be included: capital-labor ratio or energy-to-labor ratio; the percentage of workers with the highest qualifications, the average life of equipment, the share of progressive equipment in its total cost, etc. The coefficients of the multiple regression equation show how many rubles the average hourly output changes when each factor indicator changes by one in absolute terms. In order to find out how the average annual output of workers has changed due to these factors, it is necessary to multiply the resulting increases in average hourly output by the actual number of man-hours worked by one worker:

∆GVхi = ∆СBxi, * Df * Pf.

To determine their impact on the average annual output of an employee, it is necessary to multiply the resulting increases in the average annual output of workers by the actual share of workers in the total number of production and industrial personnel: ∆GVхi = ∆GVх *Udf

To calculate the impact of these factors on the change in the volume of output, the increase in the average annual output of an employee due to the i-th factor should be multiplied by the actual average number of industrial and production personnel:

∆WPxi = ∆GWxi *PPP or change in average hourly output due to i-th multiply the factor by the actual value of the length of the working day, the number of days worked by one worker per year, the share of workers in the total number of employees and the average number of employees of the enterprise:

∆VPxi = ∆SVxi *Pf *Df *UDf *PPPf. (2)

You can achieve an increase in labor productivity by:

a) reducing the complexity of products, i.e. reducing labor costs for its production by introducing scientific and technical progress measures, comprehensive mechanization and automation of production, replacing outdated equipment with more advanced ones, reducing losses in working time and other organizational and technical measures in accordance with the plan;

b) a more complete use of the production capacity of the enterprise, since with an increase in production volumes, only the variable part of the cost of working time increases, while the constant remains unchanged. As a result, the time spent on producing a unit of output is reduced.

RSV \u003d SVv - Saf \u003d (VPf + RVP) / (Tf-R ↓T + Td) - (VPf / Tf)

where R T SW ~ reserve for increasing average hourly output; SVD, SVf - accordingly, the possible and actual level of average hourly output; R T VP - a reserve for increasing gross output through the implementation of scientific and technological progress; tf- the actual cost of working time for the release of the actual volume of production; R^T - a reserve for reducing working time due to the mechanization and automation of production processes, improving the organization of labor, raising the level of skills of workers, etc.; Td- additional labor costs associated with an increase in output, which are determined for each source of reserves for increasing production, taking into account the additional amount of work necessary for the development of this reserve, and production rates.

To determine the reserve for increasing output, it is necessary to multiply the possible increase in average hourly output by the planned working time fund for all workers:

RVP=RSV*Tv

2.2 PRACTICAL PART

2.2.1 AGGREGATED BALANCE SHEET

For analytical research and a qualitative assessment of the dynamics of the financial and economic condition of an enterprise, it is recommended to combine balance sheet items into separate specific groups - an aggregated balance sheet. The aggregated type of balance is used to determine the important characteristics of the financial condition of the enterprise and calculate a number of basic financial ratios.

In fact, the aggregated balance sheet implies a certain regrouping of the balance sheet items in order to allocate borrowed funds that are homogeneous in terms of terms of return.

On the basis of the aggregated balance of articles in section II of the balance sheet liabilities, the values of Kt and Kt are obtained

Taking into account the fact that long-term loans and borrowings are directed mainly to the acquisition of fixed assets and capital investments, we will transform the original balance formula

Z+Ra =((Is+Kt)-F)+ (Kt+Ko+Rp)

From this we can conclude that, subject to the limitation of reserves and costs Z by the value (Is + Kt) -F

Z<(Ис+Кт)-F

The solvency condition of the enterprise will be fulfilled, i.e. cash, short-term financial investments and active settlements will cover the short-term debt of the enterprise (Kt + Ko + Rp)

Thus, the ratio of the cost of material circulating assets and the values of own and borrowed sources of their formation determines the stability of the financial condition of the enterprise.

The total amount of reserves and costs Z of the enterprise is equal to the total of section II of the asset balance.

On the left side of the equality, it has the difference between the working capital of the enterprise and its short-term debt, on the right side, by the value of the Et indicator. Thus, these transformations make it possible to establish reasonable relationships between indicators of the financial condition of the enterprise.

Table No. 1 Balance sheet of the enterprise (in aggregate form).

| At the beginning of the period |

At the beginning of the period |

end of period |

|||||

| I Immobilization bath products |

I. Sources of own funds |

||||||

| II. Mobile |

II. Credits and borrowings |

||||||

| Stocks and costs |

Long-term loans and borrowings |

||||||

| Receivables |

Short term loans and borrowings |

||||||

| Cash and short-term financial investments |

Accounts payable |

||||||

| Other current assets |

|||||||

| Balance |

Balance |

2.2.2. EVALUATION OF THE DYNAMICS OF THE COMPOSITION AND STRUCTURE OF THE BALANCE ASSET

Assets are usually understood as the property in which money is invested. Become and sections of the balance are arranged depending on the degree of liquidity of the property, that is, on how quickly this asset can acquire a monetary form.

Analysis of the asset makes it possible to establish the main indicators characterizing the production and economic activities of the enterprise:

1. The value of the property of the enterprise, the total balance sheet.

2. Immobilized assets, total of section I of the balance sheet

3. The cost of working capital, the result of section II of the balance sheet

With the help of analysis, you can get the most general idea of the qualitative changes that have taken place, as well as the structure of the asset, as well as the dynamics of these changes.

Table No. 2 Analysis of the composition and structure of the asset balance

After analyzing the data of the analytical table No. 2, we can draw the following conclusions.

The total value of the property decreased during the reporting period by 1.68% (100-98.32), which indicates a decline in the economic activity of the enterprise;

Reducing the value of property by 25.48 rubles. was accompanied by internal changes in the asset: with a decrease in the value of non-current assets by 23.06 (decrease by 1.9%), there was also a decrease in working capital by 2.42 (decrease by 0.79%)

The decrease in the cost of non-current assets as a whole was due to a decrease in intangible assets by 1.26% and a decrease in the cost of working capital by 27.82%.

There was a decrease by 3.97 points in settlements with debtors.

Cash also increased by 29.4 points.

Based on the overall assessment of the balance sheet asset, a decrease in the productive potential of the enterprise was revealed, which is regarded as a negative trend.

2.2.3. EVALUATION OF THE DYNAMICS OF THE COMPOSITION AND STRUCTURE OF THE LIABILITY BALANCE

For a general assessment of the property potential of the enterprise, an analysis of the composition and structure of the obligations of the enterprise is carried out.

The liability of the balance sheet reflects the sources of financing of the enterprise's funds, grouped on a certain date according to their ownership and purpose. In other words, the passive shows:

The amount of funds invested in the economic activity of the enterprise;

The degree of participation in the creation of the property of the organization.

Liabilities to owners constitute an almost constant part of the balance sheet liability, which is not subject to repayment during the operation of the organization.

An important aspect of the analysis of the structure of the balance sheet is the definition of the relationship between the asset and the liability of the balance sheet, since in the process of production activity there is a constant transformation of individual elements of the asset and liability balance. Each liability group is functionally related to an asset. Non-current assets are associated with equity and long-term liabilities, and current assets with short-term liabilities and long-term liabilities.

It is believed that in a normally functioning enterprise, current assets should exceed short-term liabilities. The other part repays long-term obligations, the rest goes to replenish equity

Table No. 3 Analysis of the composition and structure of the balance sheet liabilities.

| LIABILITY BALANCE |

At the beginning of the period RUB |

At the end of the period RUB |

Absolute deviations rub |

The rate of growth |

||

| IV Capitals and reserves Authorized capital Extra capital accumulation funds Undestributed profits Previous years Undestributed profits reporting year Total for Section IV VI Short-term liabilities Accounts payable accumulation funds Total for Section VI |

||||||

The data in table No. 3 indicates that the decrease in the value of property is mainly due to a decrease in the company's own funds. Equity capital decreased by 25.48 rubles

It should also be noted that the company practically does not attract long-term borrowed funds, i.e. there is no investment in production. Attention is drawn to the fact that in the composition of short-term liabilities, a significant amount is occupied by accounts payable in the absence of short-term bank loans, i.e. financing of working capital comes mainly from accounts payable. Its share in the structure of the company's liabilities decreased to 62.86%.

In general, there is a low autonomy of the enterprise (the share of equity capital was 35.22%) and a low degree of use of borrowed funds.

2.2.4. ANALYSIS OF THE FINANCIAL STABILITY OF THE ENTERPRISE

One of the main tasks of the analysis of the financial and economic state is the study of indicators characterizing the financial stability of the enterprise. The financial stability of an enterprise is determined by the degree of provision of reserves and costs by own and borrowed sources of their formation, the ratio of the volume of own and borrowed funds and is characterized by a system of absolute and relative indicators

In the course of production activities at the enterprise, there is a constant formation (replenishment) of stocks of inventory items. For this, both own working capital and borrowed funds (long-term and short-term loans and borrowings) are used; Analyzing compliance or discrepancy (surplus or shortage), funds for the formation of stocks and costs, determine the absolute indicators of financial stability.

Table No. 4 Analysis of the financial stability of the enterprise.

| INDICATOR |

At the beginning of the period RUB |

At the end of the period RUB |

Absolute deviations (rub) |

The rate of growth |

| 1. Sources of own funds (Es) |

||||

| 2. Non-current assets (F) |

||||

| 3. Own working capital (EU) (1-2) |

||||

| 4. Long-term loans and borrowings (Kt) |

||||

| 5. Availability of own working capital and long-term borrowed sources for the formation of reserves and costs (Et) (3 + 4) |

||||

| 6. Short-term loans and borrowings (Kt) |

||||

| 7. The total value of the main sources of formation of reserves and costs (E∑) (5+6) |

Continuation of table No. 4

The data of table No. 4 give us the opportunity to understand that this enterprise is in a critical position, this is determined by the conditions:

three-dimensional indicator S=(0.0.0)

A financial crisis is the brink of bankruptcy: the presence of overdue accounts payable and receivable and the inability to repay them on time. In a market economy, with repeated repetition of such a situation, the enterprise is threatened with declaring bankruptcy.

This conclusion is made on the basis of the following conclusions:

Stocks and costs are not covered by own working capital

The main reason for the deterioration of the financial position of the enterprise is that its own working capital and the total value of sources of formation (E) decreased by 94.73%.

2.2.5. RELATIVE INDICATORS OF FINANCIAL STABILITY

The main characteristic of the financial and economic condition of an enterprise is the degree of dependence on creditors and investors. It is desirable that in the financial structure of the organization there should be a minimum of own capital and a maximum of borrowed capital. Borrowers evaluate the stability of the enterprise by the level of equity capital and the probability of bankruptcy.

Financial stability depends on the state of own and borrowed funds.

The analysis is carried out by calculating and comparing the obtained values of the coefficients with the established base values, as well as studying their dynamics from changes during the reporting period.

Table No. 5 Calculation and analysis of relative financial stability ratios.

| INDICATOR |

At the beginning of the period RUB |

At the end of the period RUB |

Absolute deviations (p) |

The rate of growth |

|||

| 1. Enterprise property. Rub (B) |

|||||||

| 2. Sources of own funds (capital and reserves) RUB (Is) |

|||||||

| 3. Short-term liabilities rub(Kt) |

|||||||

| 4.Long-term liabilities RUB (Kt) |

|||||||

| 5. Total borrowings (Кt+Кт) |

|||||||

| 6. Non-current assets rub (F) |

|||||||

| 7. Current assets rub (Ra) |

|||||||

| 8. Stocks and costs (Z) |

|||||||

| 9. Own working capital RUB (EU) (2..6) |

|||||||

| COEFFICIENT |

Interval of optimal values |

For the beginning of the year |

At the end of the year |

Absolute deviations (p) |

The rate of growth |

||

| 10.Autonomy (Ka) (2:1) |

|||||||

| 11. The ratio of borrowed and own funds (Kz / s) (5: 2) |

|||||||

Continuation of table No. 5

Based on the data in Table 5, we can conclude that financial independence is high. This is confirmed by the high value of the autonomy coefficient (Ka). Despite the decrease in the property potential of the enterprise by 1.75%, it managed to maintain its financial position. However, there is a decrease in the maneuverability coefficient, it decreased by 7.4%, and at the end of the year its value was 1.26. This is due to the fact that most of the funds are invested in non-current assets, which is confirmed by the low value of the ratio of mobile and immobilized funds (Km/i).

2.2.6. ANALYSIS OF LIQUIDITY AND SOLVENCY OF THE ENTERPRISE.

The need for balance sheet liquidity analysis arises in market conditions due to increased financial constraints and the need to assess the creditworthiness of an enterprise. The liquidity of the balance sheet is defined as the degree of coverage of the obligations of the enterprise by its assets, the period of transformation of which into cash corresponds to the maturity of the obligations.

The liquidity of assets is the reciprocal of the liquidity of the balance sheet by the time the assets are converted into cash. The less time it takes for this type of asset to acquire a monetary form, the higher its liquidity.

Analysis of the liquidity of the balance sheet consists in comparing the funds of the asset, grouped by the degree of their liquidity and location in descending order of liquidity, with the liabilities of the liability, grouped by their maturity and arranged in ascending order of terms.

Table No. 6 Analysis of the liquidity of the balance sheet of the enterprise.

Continuation of table No. 6

The asset of this balance sheet was filled in by an accountant, not taking into account some factors, which led to the discrepancy between the table on the asset balance sheet.

The data in table No. 6 make it clear and evaluate not only the enterprise, but also how the balance sheet was filled.

After analyzing this table, we will see that at this enterprise there is a lack of the most liquid, quickly selling and difficult to sell assets, but there are too many slowly selling assets.

The percentage of coverage of obligations is very small, which gives a negative characteristic of this enterprise.

2.2.7. CASH FLOW ANALYSIS.

The need for cash flow analysis is due to the fact that sometimes a rather paradoxical situation arises in economic activity when a profitable enterprise cannot make settlements with its employees.

The main purpose of the cash flow analysis is to assess the ability of the enterprise to generate cash in the amount and in time required to implement the planned costs. The solvency and liquidity of an enterprise are often dependent on the real cash flow of the enterprise in the form of a stream of cash payments passing through the accounts of an economic entity.

Table No. 7 Calculation and analysis of liquidity ratios

| INDICATOR |

For the beginning of the year |

At the end of the year |

change |

||

| 1.Cash, rub |

|||||

| 2. Short-term financial investments, rub |

|||||

| 3.Total cash and short-term financial investments |

|||||

| 4. Accounts receivable |

|||||

| 5.Other current assets |

|||||

| 6.Total accounts receivable and other assets, rub |

|||||

| 7.Total cash, financial investments, accounts receivable |

|||||

| 8. Reserves and costs, rub |

|||||

| 9.Total working capital |

|||||

| 10.Current liabilities |

|||||

| COEFFICIENT |

Interval of optimal values |

For the beginning of the year |

At the end of the year |

change |

|

| 11.Coating (Kp) |

|||||

| 12.Critical Liquidity (Ccl) |

|||||

| 13.Absolute Liquidity (Kal) |

|||||

After analyzing table number 7, we see that:

In the reporting period, the cash balance increased by 0.05 rubles. and at the end of the period amounted to 0.44 rubles.

Accounts receivable decreased by 3.54, which amounted to 85.74 at the end, while inventories increased by 1.07.

3. CONCLUSION

After a fairly thorough analysis of the enterprise on its balance sheet, it is possible to give a complete description of the work of the enterprise in the reporting period.

What is clearly shown in this course project.

After all, having analyzed the balance sheet of the enterprise, it became clear to us that the enterprise almost does not carry out operations, take at least a current account, it has changed by 0.05 t.r for the reporting period. The situation is similar with other operations at this enterprise.

Having made all the calculations and conclusions, it becomes clearly visible that this enterprise is in a critical situation and that if measures are not taken by the management of this enterprise in the near future, then most likely the enterprise is not waiting for fun to take into account, namely bankruptcy.

4. LIST OF LITERATURE

Theory of economic analysis.

Edited by Bakanov M.I., Sheremet.A.D.

Method of financial analysis

Finance and statistics MOSCOW 1993

Edited by Sheremet.A.D. Saifulin R.S.

Analysis of the economic activity of the enterprise

MINSK1998 IP "Ekoperspektiva"

Edited by Savitskaya G.V.

Financial and economic condition of the enterprise

MOSCOW 1999

Edited by Bykodorov V.L. Alekseev P.D.

On the analysis of the solvency and liquidity of the enterprise

Accounting 1997#11

Edited by Fazevsky V.N.

Economic activity is an activity that is aimed at the production or exchange of goods, tangible and intangible benefits. There are several types of economic activity, each of which arose at different times and had its own development path.

Agricultural activity

Agriculture is to meet the needs of the population in food. Agriculture can be divided into two branches: animal husbandry and crop production. Crop production originated when a person realized that food can not only be obtained by developing more and more new territories, but also to cultivate food crops. Animal husbandry, in turn, appeared at the moment when man began to domesticate wild animals in order to obtain milk, meat and wool.

Rice. 1. Agriculture.

Land is the main means of agricultural production.

Industry

This area of activity includes the mining and manufacturing industries. The formation of industry took place in the era of the primitive communal system. It was inseparable from subsistence farming. Later, industry becomes a completely independent industry, which is developing rapidly, especially during the formation and birth of capitalism. In the industrial sector, one can single out the fuel, light, food, timber industries, as well as ferrous and non-ferrous metallurgy.

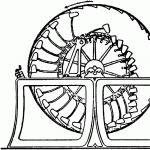

Rice. 2. Mining.

Transport economy

For the stable operation of agricultural and industrial enterprises, stable operation of transport is necessary.

Transportation can be divided into 3 types:

- air transport (airplanes, helicopters);

- land transport (cars, metro, trains);

- water transport (ships, river and sea vessels).

The transport industry often depends on external conditions, because travel and transportation of goods are often made over long distances.

Services sector

The service sector is also a type of economic activity. Only here the end result is not a product, but some intangible object - training, treatment, provision of services. Science, health care and education are branches of economic activity that can be attributed to the service sector. Health care is concerned with the treatment and protection of the health of the population.

Rice. 3. Health care.

Education is divided into pre-school, secondary and higher education. The development of science in developed countries is given great importance. After all, her contribution to the development of the state is very great. It is the countries that have great knowledge in the field of science, which attract specialists, have a powerful economy.

TOP 2 articleswho read along with this

Construction

This industry is engaged in the construction of new residential and industrial facilities, as well as their reconstruction. The main role is to create conditions for the rapid development of the economy of a country. Construction products are buildings and structures, as well as the work that is necessary for the construction of buildings.

What have we learned?

The end result of any economic activity is a product or any tangible or intangible services. There are several main types of economic activity. These include agriculture, industry, transport, construction, services.

Report Evaluation

Average rating: 3.3. Total ratings received: 12.